Running a restaurant in India is more than serving good food. It also requires following government rules for billing and taxation. Every restaurant needs to issue proper invoices, and the restaurant bill format plays a big role in ensuring compliance. Many customers also want clarity on their bills, and the right format avoids disputes. Just like you may search online for how to check amazon pay balance, customers expect the same transparency in their restaurant payments.

Why Restaurant Bill Format Matters

The Indian government made GST compulsory for many businesses, including restaurants. Under this law, restaurants must issue bills that meet certain requirements. A restaurant bill format is not just a slip of paper but a legally valid tax invoice. It records sales, shows tax, and serves as proof for both the business and the customer.

When restaurants use an organized format, they gain trust. Customers can easily see what they are paying for, and owners avoid legal issues. This transparency improves the dining experience and builds long-term loyalty.

Basic Requirements of a Restaurant Bill

The law under GST specifies details that must appear in every restaurant bill. These include the name and address of the restaurant, GSTIN, bill number, and the date. Along with these, the restaurant bill format should clearly list each food item, its quantity, and price.

A proper bill also includes tax details such as CGST and SGST. If the service is provided across states, IGST is applied instead. The customer must be able to see the subtotal, tax amount, and the grand total clearly. This clarity keeps both parties safe from confusion or disputes.

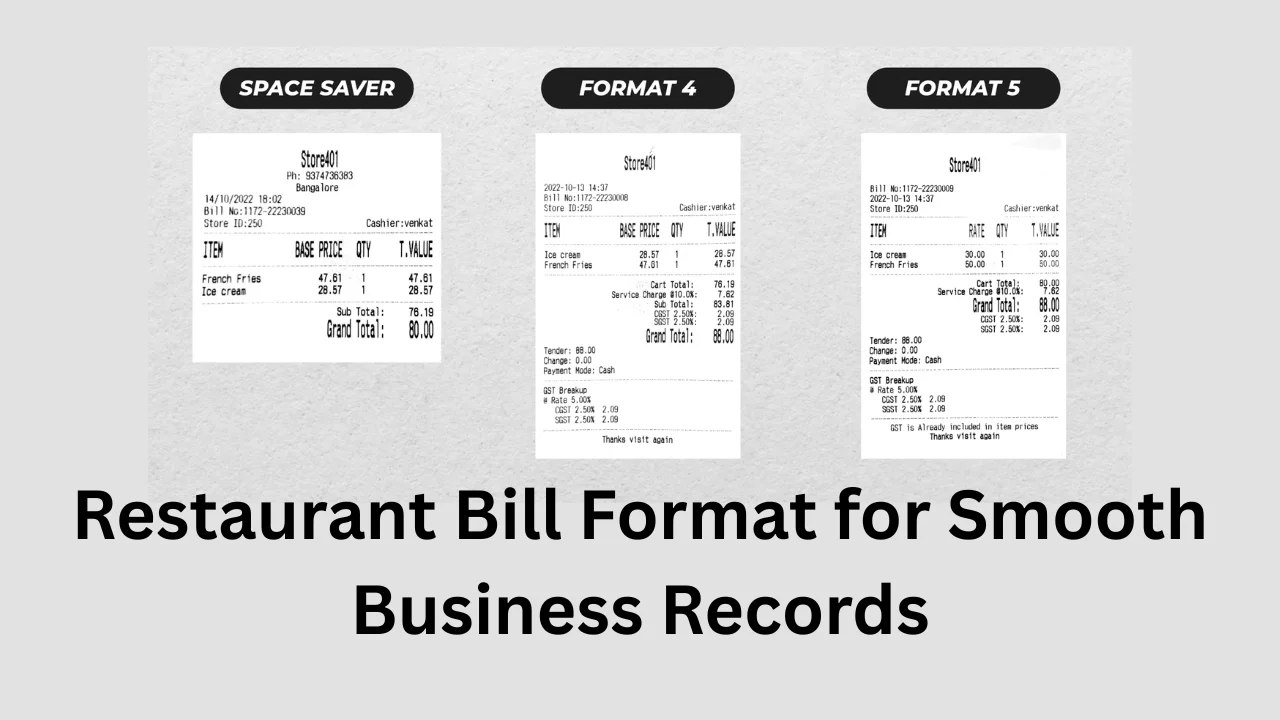

Sample Layout of a Restaurant Bill

Here is an example table that shows the structure of a simple restaurant bill.

| Item Name | Quantity | Rate (₹) | Amount (₹) |

|---|---|---|---|

| Paneer Butter Masala | 2 | 220 | 440 |

| Butter Naan | 4 | 50 | 200 |

| Soft Drink | 2 | 40 | 80 |

Subtotal: ₹720

CGST @2.5%: ₹18

SGST @2.5%: ₹18

Grand Total: ₹756

This table shows how the restaurant bill format works. Each detail is written in a clear way, making it easy for the customer to understand the charges.

GST Rules for Restaurant Bills

The GST Act requires specific information on every bill. If the customer is registered under GST and the bill is above ₹50,000, then the customer’s name and GSTIN must be mentioned. Smaller bills can be simpler but still need the restaurant’s GSTIN.

Restaurants not registered under GST issue a simpler bill called a bill of supply. This bill does not have GST breakup but still lists items and total value. In both cases, the restaurant bill format must stay professional and consistent.

Role of FSSAI in Restaurant Bills

Apart from GST, the Food Safety and Standards Authority of India (FSSAI) plays a role. Every restaurant must display its FSSAI license number, and many include it on the bill. This practice assures the customer that the food meets safety standards. A well-designed restaurant bill format often carries this number at the bottom or top of the invoice.

Service Charges and Transparency

There has been debate about service charges in India. Some restaurants add a percentage to the final bill, while others leave it optional. The government has clarified that service charges are not mandatory, but restaurants must be upfront about them. A good restaurant bill format shows service charges separately so that the customer knows what they are paying for.

When customers see clear details, they are less likely to argue about hidden costs. This builds better relationships and protects the reputation of the restaurant.

Importance for Business Records

A restaurant is a business, and every business must keep proper records. Bills form a major part of these records. The restaurant bill format ensures that the data can be stored easily for accounting and audits. It also helps in financial planning, as owners can track sales trends and popular dishes.

For example, if the monthly report shows that paneer dishes bring more revenue, the restaurant can promote them. Proper bills also support filing accurate GST returns, avoiding penalties.

Digital Restaurant Bill Format

Technology has changed billing in restaurants. Many use POS (Point of Sale) systems that generate digital invoices. These invoices can be printed or sent directly to the customer’s phone. The digital restaurant bill format is faster, safer, and reduces errors.

Digital billing also allows integration with payment methods like UPI, cards, and wallets. Just like a customer may look up co-operative bank balance check number, they expect quick access to their restaurant bills. A digital format fulfills this modern expectation.

Comparison Between Regular and GST Restaurant Bills

| Feature | Regular Bill | GST Restaurant Bill |

|---|---|---|

| Tax Shown | No | Yes (CGST/SGST/IGST) |

| GSTIN Mentioned | No | Yes |

| Legal Validity | Limited | Full Tax Invoice |

| Customer Transparency | Moderate | High |

This comparison shows why the restaurant bill format under GST is more reliable. Customers and businesses both benefit from the detailed structure.

Common Mistakes to Avoid

Some restaurants forget to include GSTIN or the correct tax breakup. Others use random serial numbers without following sequence rules. These mistakes can attract penalties during audits. A correct restaurant bill format avoids these risks by keeping everything systematic.

Another mistake is hiding service charges inside item rates. Customers often complain when they notice unexplained amounts. The law requires all charges to be shown clearly, and the right format ensures compliance.

Future of Restaurant Billing

The future is moving toward full digitalization. E-invoices are already in use for larger businesses, and restaurants may soon adopt them widely. Mobile apps, QR codes, and direct digital receipts will make the restaurant bill format even more customer friendly.

Customers prefer instant access to bills, and businesses save time and effort with automated systems. This trend shows that billing will be smoother, faster, and more transparent in coming years.

Conclusion

The restaurant bill format is more than a formality. It is a legal tool, a business record, and a customer service element. When done properly, it keeps the restaurant safe from penalties and gives customers confidence in their purchase. From GST rules to FSSAI requirements, every detail has to be followed carefully.

As the industry grows and technology improves, restaurants that adopt clear and digital billing will stand out. Just as customers value easy payment methods and transparency in their finances, they also want the same clarity in dining. The right bill format is not just about compliance, it is about building trust and offering a professional experience.